Why an LLC is the Best Choice for Your Trucking Business

In the fast-paced trucking and logistics world, picking the right business structure is key to success. While a Sole Proprietorship (DBA) or Corporation has its benefits, an LLC often stands out as the top choice for trucking businesses. Let's explore why an LLC is great for your trucking company, especially if you work with 1099 contractors.

Benefits of an LLC for Trucking Companies:

1. Limited Liability Protection:

One of the primary advantages of an LLC is the limited liability protection it offers. As a trucking business owner, you face many risks. An LLC keeps your personal assets separate from your business liabilities. This means your personal things like your home, car, and savings are safe if legal issues or debts come up.

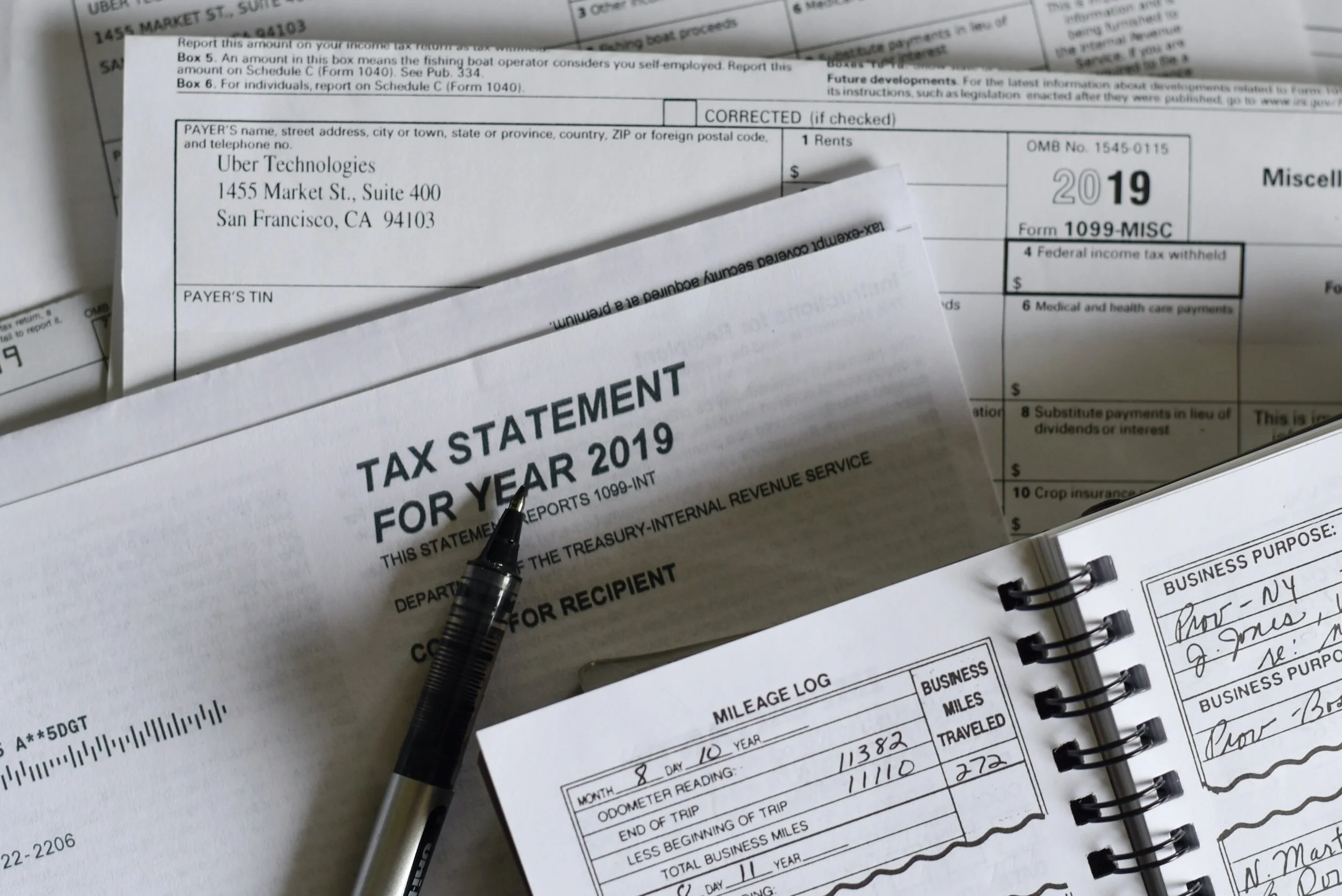

2. Tax Flexibility:

LLCs give you more tax options than Corporations. You can choose to be taxed as a sole proprietor, partnership, or corporation. This control can lead to big tax savings, especially for small and medium trucking companies.

3. Less Paperwork and Formalities:

LLCs don't need to hold annual meetings or keep lots of records like Corporations. This means less admin work for you, so you can focus on running your business.

4. Credibility and Professionalism:

An LLC makes your business look more professional and credible. Clients, vendors, and banks often see LLCs as more stable and reliable. This can help you get contracts and grow your business.

For 1099 Contractors: Navigating Challenges and Seizing Opportunities with an LLC

Independent Contracting Uncertainties

you enjoy being your own boss. But this comes with challenges like unstable income and job security. Here's where an LLC can really help. It offers liability protection and tax flexibility, which are vital for any business. Plus, it boosts your professional image as an independent contractor. An LLC shows you're serious about your business. It also opens doors to more business growth and partnerships.

How an LLC Helps

An LLC can change the game for 1099 contractors. Here's how:

Enhanced Credibility: As an LLC, you're no longer just an individual; you're a recognized business entity. This can significantly boost your credibility with potential clients, making it easier to secure more stable and lucrative contracts.

Financial Safety: An LLC separates your personal and business money. This protects your personal assets from business debts or legal problems. It also makes managing your finances easier.

Tax Advantages: LLCs offer potential tax benefits for 1099 contractors. Depending on your situation, you might find more favorable tax treatment for your earnings and expenses, helping to stabilize your financial situation.

Flexibility and Growth Potential: With an LLC, you have the flexibility to expand your business operations, hire employees, or even partner with other contractors. This can open up new avenues for growth that go beyond what's typically possible for an individual contractor.

Empowering Your Trucking Career

Choosing an LLC means protecting yourself and setting up for a stable, profitable trucking career. It's a big step towards turning your independent work into a successful business.

Ready to Grow Your Trucking Business?:

MHR Logistics is here to help trucking companies and independent contractors smoothly transition to an LLC. Our experts will guide you, ensuring your business is set up for success. Contact us to learn more about our entity creation services and start building a more secure business future.

Please Note: This blog post is for general information only. It's not legal, tax, or professional advice. Your business's specific needs can greatly affect which structure is best. We recommend talking to a qualified attorney or tax professional. MHR Logistics offers guidance based on our experience, but we urge you to get personalized advice from experts.